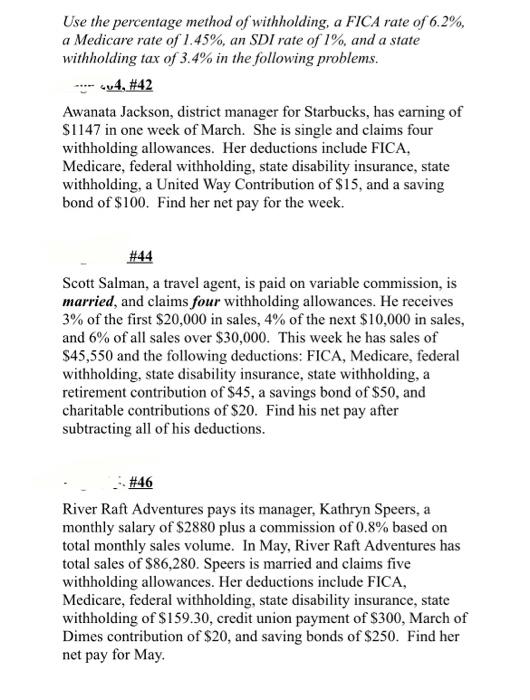

Fica Percentage 2025 - FICA Tax Rate What is the percentage of this tax and how you can, For 2025, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2025). Solved Use the percentage method of withholding, a FICA rate, 2025 fica limits were announced in early october 2025 and increased approximately 4.4%.

FICA Tax Rate What is the percentage of this tax and how you can, For 2025, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2025).

Fica Percentage 2025. According to the intermediate projection issued in a may 2025 report, the social security taxable wage next year will be $174,900. The maximum 2025 social security component of the federal insurance contributions act tax payable by each employee will be $10,918.20, or 6.2% of the taxable.

Federal Tax Percentage 2025 Candis Roxanne, The maximum 2025 social security component of the federal insurance contributions act tax payable by each employee will be $10,918.20, or 6.2% of the taxable.

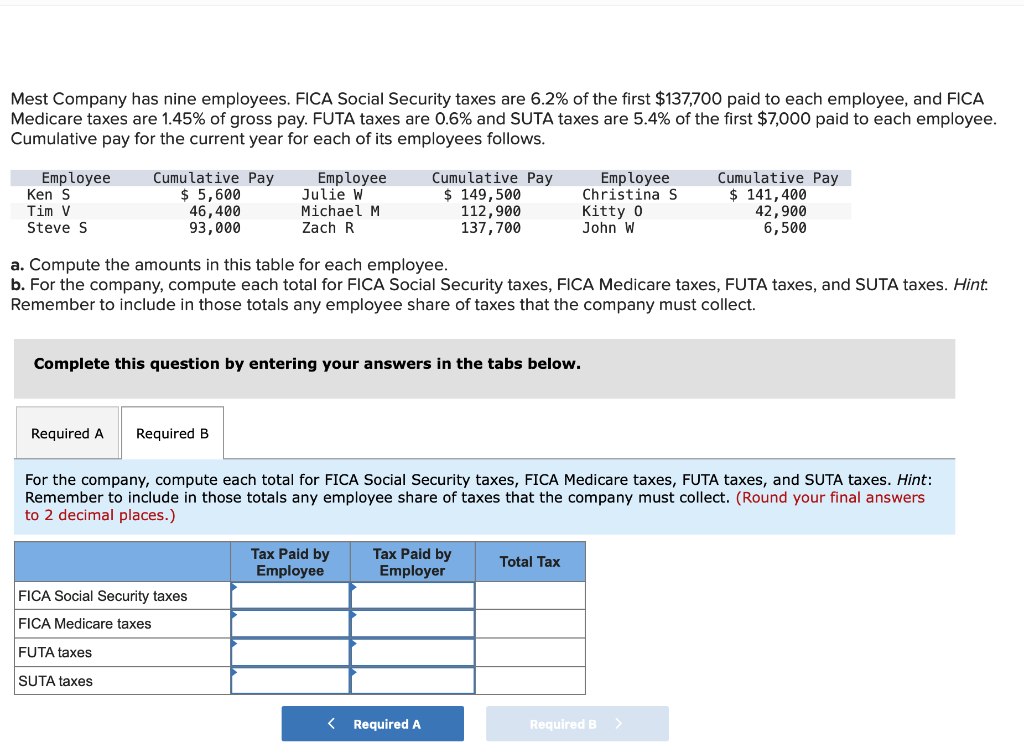

Solved Mest Company has nine employees. FICA Social Security, Old age and survivors disability insurance (oasdi), and;

They generally add up to 7.65% of your wages or salary and are mandatory. The maximum amount of earnings subject to social security tax is $176,100 for.

Fica Maximum 2025 Janaye Sherill, The total federal insurance contribution act (fica) tax rate is made up of two components:

Fica Taxes Percentage In Powerpoint And Google Slides Cpb, Fica tax rates for 2025 and 2025 in 2025, only the first $168,600 of your earnings are subject to the social security tax.

What Is Fica Limit For 2025 Dacia Dorotea, The fica rate in 2025 remains consistent with the fica rate in 2023 at 7.65%.

Maximum Taxable Amount For Social Security Tax (FICA), For 2025, employees will pay:

Recent important FICA amendments you should be aware of, Medicare taxes (2.9%) have no cap on earnings.